Exploring into the realm of Savings plan, we encounter the intriguing concept of universal life insurance savings plans. These financial instruments epitomize a fusion of conventional savings strategies, insurance safeguards, and the conventional banking paradigm. So instead of only 100% of your money will be returned to your loved ones in the case of death, you will get a little higher return for example 105%. On top of that, normal conventional savings of lock in period does not apply like your banks offering 2.5% interest per annum but a lock in period of 1 year.

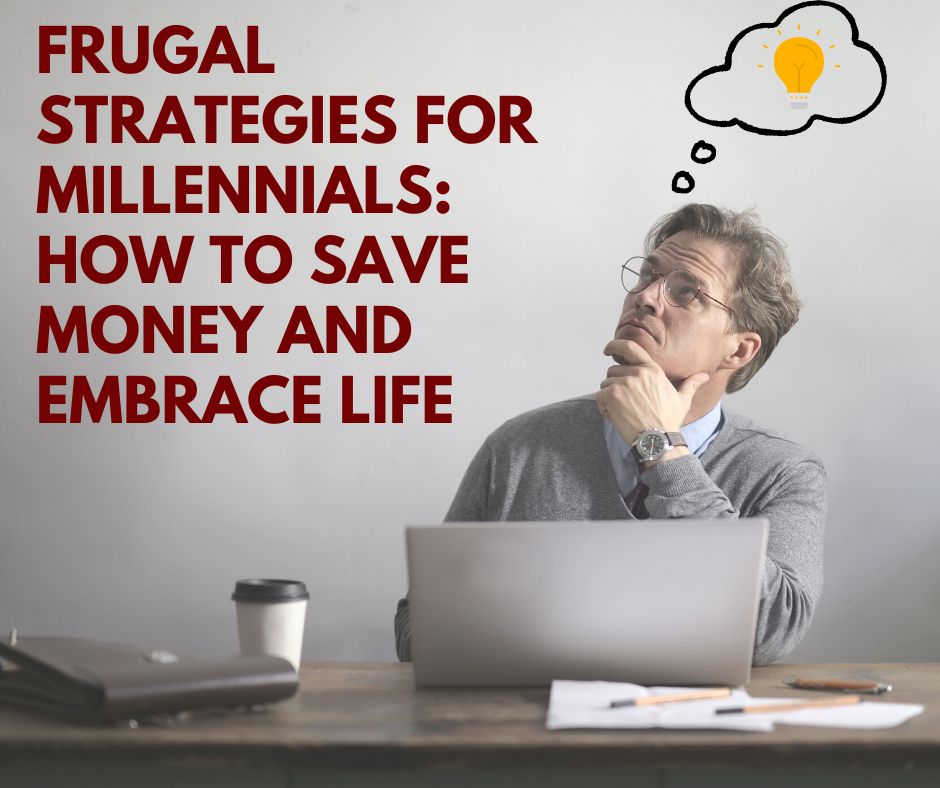

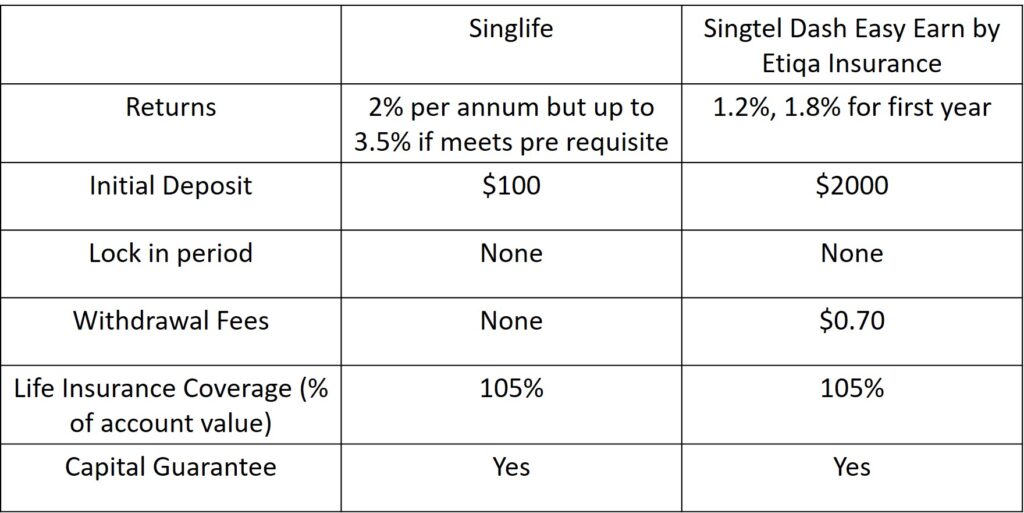

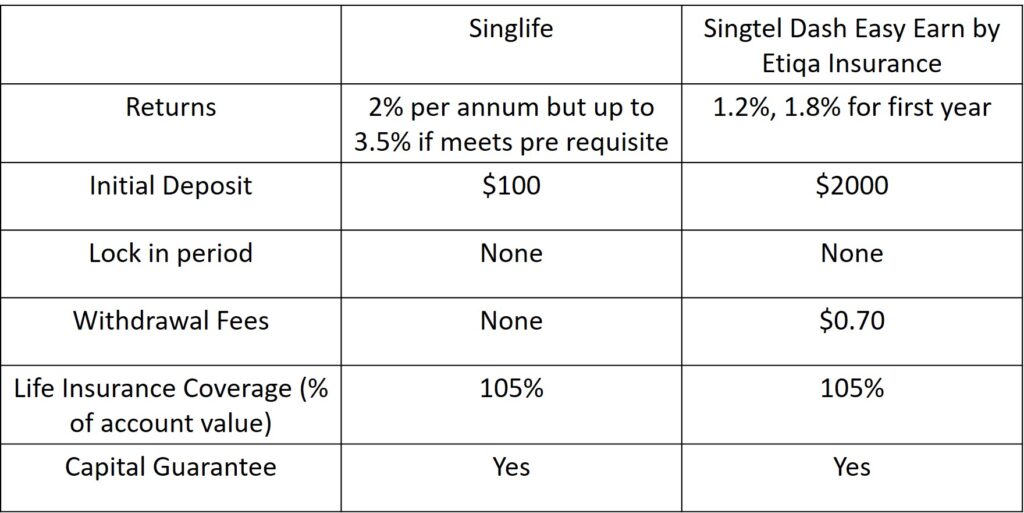

Diving in, we spotlight the Dash EasyEarn and the Singlife Account, both representing universal life plans that entice with an enticing crediting rate on invested capital.

It’s important to note that while the capital you commit is safeguarded, the crediting rate remains subject to fluctuations. Furthermore, the returns materialize on a daily basis, culminating in monthly account updates.

Beyond financial gains, these plans also provide a layer of insurance coverage, adding an extra layer of appeal. Should this pique your curiosity, we invite you to embark on a comparative journey to discern which aligns best with your financial aspirations.

Table of Contents

ToggleAre Insurance Savings Plans a Sanctuary?

Rest assured in Singapore, insurance savings plans nestle under the aegis of the Policy Owners’ Protection (PPF) Scheme, vigilantly administered by the Singapore Deposit Insurance Corporation (SDIC) up to $75,000.

For a comprehensive understanding of the extent and nature of these protective benefits, we recommend exploring the resources available through the Life Insurance Association (LIA) and SDIC websites.

For those still harbouring doubts about committing to an insurance savings plan, rest assured that all policies come furnished with a 14-day grace period, allowing termination without incurring penalties. This will be a tip for those in buyer’s remorse stage be it any insurance that you sign on with, within 14 days of signing that paper and paying the account, you have the right to cancel it and get back 100% of your money. So check the fine print and it will save you the trouble next time.

The Singlife Account: A Glimpse Into Potential Gains

The Singlife Account indicates itself as a capital-guaranteed insurance savings plan, offering returns of up to 3.5% per annum, contingent upon meeting certain prerequisites. Although it is not guaranteed but we would say based on our experience it has definitely generated more interest than your normal savings account in the banks

So what are the prerequisites to earn up to 3.5% per annum?

1) 2% per annum is on the first $10,000

2) Up to $810 cash bonus from SInglife Account Special Incentive Campaign *for the first 1000 customers*

3) 0.5% from Singlife Sure Invest Bonus Return Campaign

4) 0.5% from Singlife Top-Up Account Campaign

What Became of the Singlife Debit Card?

Previously each member has been given a debit card like the bank and you can use it as payment however it was discontinued effective July 6, 2023. But not too worry, you still can transfer it to your normal bank account and top it up back. However there will be charges incur. So to start an account and continue to reap the benefits, your Singlife Account needs to have a minimum of $100. Top-ups and withdrawals, the FAST channel ensures a frictionless experience.

Singtel Dash EasyEarn by Etiqa Insurance

While Dash EasyEarn embraces the universal life plan archetype, its coverage extends to a narrower spectrum compared to traditional counterparts. Upon your untimely demise, Etiqa pledges to disburse 105% of your account balance, offset by any outstanding obligations. This payout model persists as you approach the centenary milestone, offering 105% of your account balance before your 100th birthday.

Our current credit rate without any top up that we did is 1.2% which is considered alright coming from no top up monthly or fees. However to start an account it is way higher that Singlife, $2000. States in the website you will be credited up to 1.8% per annum for the 1st year policy. *Guaranteed rate of 1.5% and 0.3% for 1st policy year for a limited time only*

So the down side of owning this account is the withdrawal fee which is $0.70.

Considering the facts that we shared, we believe that there’s more out there that will be better than this. But if you are solely putting money in the banks and not doing nothing, this will be a better option as it will land you a better interest rate. This is definitely not adding into any perks that they offer with any other plans or bonuses if you sign extra plans with them, it is solely an interpretation of just one of the product they offer. Of course it is your choice where ever you want to park your money however share the good stuff if you have so that the rest of us will benefit from it.